Builder’s Risk vs. Installation Floater: Know the Difference

If you’re a contractor, you’ve probably heard both terms: Builder’s Risk and Installation Floater.

They sound similar. They both cover materials and equipment during construction.

But they serve different purposes—and mixing them up can leave serious gaps in coverage.

Let’s break it down.

What Is Builder’s Risk Insurance?

Builder’s risk is a property insurance policy for the entire construction project.

It typically covers:

The building or structure under construction

On-site materials

Temporary structures

Off-site storage and materials in transit (if endorsed)

Soft costs and delay coverage (if added)

Who buys it? Usually the owner or GC

Who’s covered? Owner, GC, subcontractors, and sometimes others

Purpose: To protect everyone’s interest in the project as a whole

What Is an Installation Floater?

An installation floater is typically purchased by a contractor or subcontractor.

It covers:

Materials and equipment to be installed

Property in transit

Property stored off-site before installation

But here’s the key difference:

It only covers what you are responsible for—your scope of work.

Example: An HVAC contractor buys an installation floater to cover ductwork, units, and tools in transit and during installation.

It does not cover the full jobsite or the building itself.

When Would a Contractor Use an Installation Floater?

When they’re working on a project that doesn’t carry builder’s risk coverage

When the builder’s risk policy doesn’t cover their property adequately

When they want more control over their own materials and equipment coverage

In some cases, contractors carry both a CGL policy (for liability) and an installation floater (for property) as their default setup—especially for small or short-term jobs.

Can You Rely on Just One?

No—they’re not interchangeable.

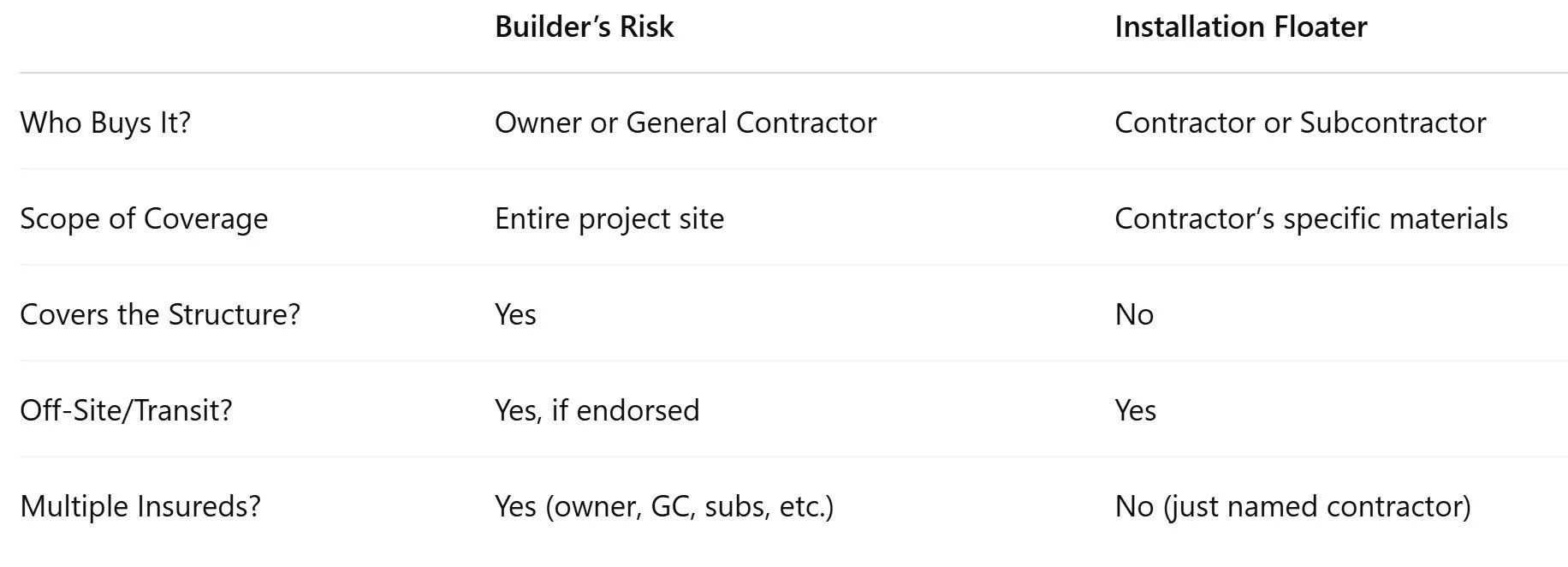

Here’s a quick comparison:

Builder’s Risk vs Installation Floater

Bottom Line

If you’re a contractor or subcontractor, don’t assume the GC’s builder’s risk policy covers your materials.

And if you’re the GC or owner, make sure your builder’s risk policy is structured to include all relevant parties and property.

Know what you’re responsible fo

Review who’s covered

Don’t leave gaps between policies

Not sure whether your project needs a builder’s risk policy, an installation floater, or both?

Let’s review your setup before something goes missing or gets damaged.